Defying Eroom's Law

November 15, 2023 | Chris Williams

A Revolution for Rare Disease:

Defying Eroom's Law with Innovative Business Models

A Widely Recognized Challenge

Jones, Richard & Wilsdon, James. (2018). The Biomedical Bubble: Why UK research and innovation needs a greater diversity of priorities, politics, places and people. 10.13140/RG.2.2.15613.05609.

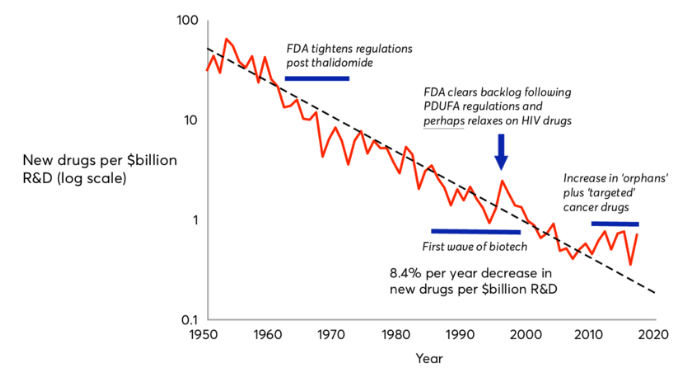

I did not think much about the implications of Eroom’s law [the consistent rise in cost of drug discovery over the past 70 years] until I started working on gene therapies. Our work to lower the cost of manufacturing genetic therapies led me to investigate the other economic challenges in treating rare diseases. Even if we can lower the cost of manufacturing gene therapies, the observation that our industry now spends over $1B to develop a new drug obviates the premise of developing gene therapies. This is economically unsustainable for rare diseases affecting only several-hundred to a couple-thousand patients in Europe and North America. Forget about sustainably repeating this 1000s of times to cover the volume and diversity of known rare genetic diseases, and provide access to ROW markets. As with many of the programs I have supported over the past 14 years of translating research innovations into clinical products, the largest barriers are often not technical. As always though, the potential health benefits for patients when we are successful make it worth a deeper dive to understand and solve these problems.

The Inequality Problem

Source: https://companiesmarketcap.com/pharmaceuticals/largest-pharmaceutical-companies-by-market-cap/

Wikipedia, my quick-and-dirty first stop in seeking the causes of Eroom’s law, offered some pointed insights. Their listed causes, which may not necessarily apply to rare genetic diseases as indicated by the recent inflection in the figure, include:

- `Better than the Beatles problem´

- Most rare diseases have no treatment options to compare to

- `Cautious Regulator problem´

- There are several incentives encouraging development for orphan indications

- Throw money at it tendency

- There is currently too little funding for research in rare diseases

- `Basic Research – Brute Force’

- By definition, genetic diseases have an identified root cause and there are modular tools to try and fix them

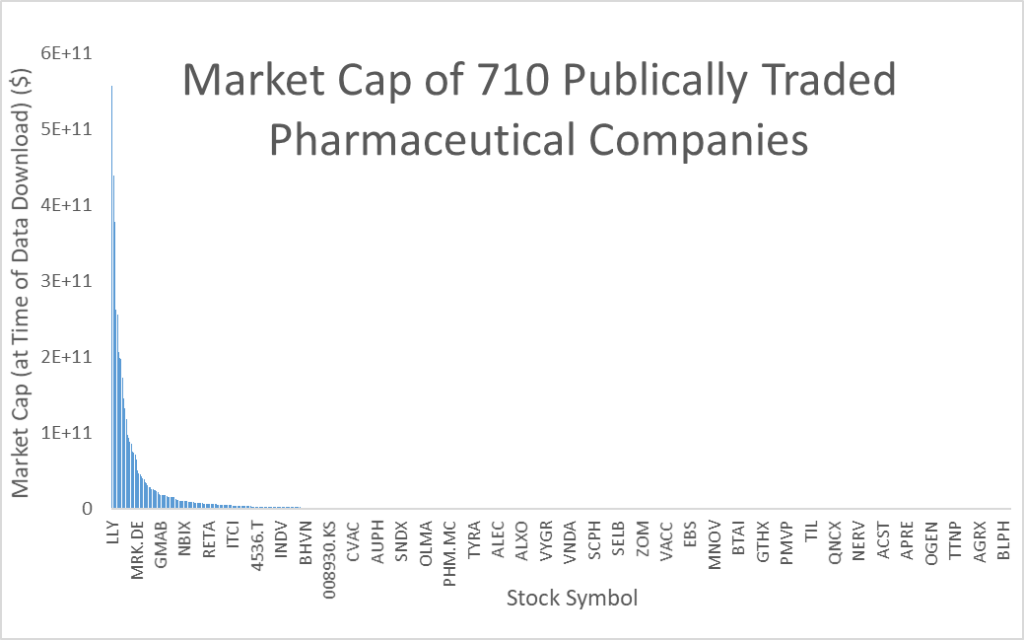

There was also a fifth cause, or critique rather, that the pharmaceutical industry has become an oligopoly, resulting in lost innovation and efficiency. There is at least some mathematical evidence to this theory. Allianz states the “low fragmentation” in the pharmaceutical industry, “where the top 5 players together hold 30% [36%] market share, while the top 10 hold 50% [54%] of the market” as one of pharma’s economic strengths. In some other contexts, this skewed distribution of wealth and income is called economic inequality.

Economic inequality, a concept usually used in the context of population demographics, is often measured by the ´Gini Coefficient´ [A scale from 0 universal equality to 1 monopoly over resources]. The United States, where wealth inequality has become a serious societal issue, has a Gini Coefficient of 39.8. South Africa (congratulations to the Springboks for winning the RWC!) has the highest Gini coefficient at 63. The Gini Coefficient on market cap of publicly traded pharmaceutical companies is 93! Reducing the data set from all 710 globally traded pharmaceutical companies to only the 483 based in the United States has no impact on the calculation; also 93.

Economic inequality is a much bigger societal issue than Eroom’s law, and so there has been much deeper analysis on its causes and consequences. Analyzing the pharmaceutical sector through the lens of economic inequality, rather than market fragmentation, exposes some unflattering insights. In a highly unequal society, the wealthy are often accused of:

- Influencing political policy in their favor

- $377M spent in 2022 on Pharmaceutical/Healthcare lobbying in USA

- Manipulating the less wealthy majority

- $14B spent in 2021 on digital advertising in the USA, a practice outlawed in most countries

- Using complex legal means to protect wealth

- Currently 8 IRA lawsuits filed against Medicare, the largest payer for health care services in the United States

A Hypothesis – Impact on Industry Output

Source: https://companiesmarketcap.com/pharmaceuticals/largest-pharmaceutical-companies-by-market-cap/

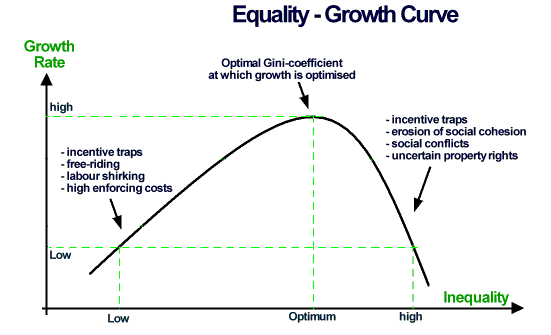

Theatrics aside, the most important question is how economic inequality affects economic growth and output. The literature is mixed. Some sources say inequality can drive economic growth by providing the incentives for innovation and efficiency. Other sources say growth is stifled because of the numerous detriments of poverty [in this case the impoverished is the bottom 90% (640) of publicly traded pharma companies working with only 10% of the sector’s capital].

One explanation for the mixed observations between economic inequality and growth is the source of value generation in a sector. Sectors that rely more heavily on physical capital can experience higher growth due to the concentration of capital infrastructure and economies of scale. However, sectors that rely on human capital will often experience a stifling of growth as wealth aggregates away from the majority of the skilled workforce. As someone who spent more than a decade working in a pharmaceutical development lab, I can say with high confidence that we never have enough people and a surplus of barely used lab equipment is often standing idle.

So if it really is the starkly skewed distribution of resources in our industry that is contributing to stifled economic output from an “impoverished” majority of players, how can we fix that? On top, how do we fix this in a way that is supportive of developing hundreds-to-thousands of new therapies for rare genetic disease?

A Potential Solution

A second look at our industry through the lens of broader economic trends, one potential solution could be experimentation with collaborative and decentralized business models. Examples like AirBNB, Uber, Youtube, and Amazon have risen to the top of their respective industries by providing platforms for individuals and small businesses to deliver value to customers. Much of this value creation has been through providing niche products, services, and content to small and unique customer bases. While a quirky yurt in Buchanan, Michigan is never going to be as profitable as the Hilton in downtown Manhattan, it still has value to off-the-grid glampers. Similarly, bespoke gene therapies may never be as profitable as another TNF inhibitor, but they still can have tremendous value to the patients who need them.

Collaborative business models have the potential to stimulate growth through the more efficient use of human capital and intellectual property. Open innovation and knowledge sharing reduces redundant development that contributes to duplicate costs to achieve the same outcome. Through collaborations, the impact of innovation spreads beyond the boundaries of the inventor and is not bottlenecked by the capital holding of a single institution. With sufficient network effects, synergies can arise by combining the best innovations regardless of where they originate. Altogether, this ecosystem could not only contribute to the more efficient output of more products, but could make those products better as well.

Both established and experimental frameworks for collaborative working models in science and drug development already exist. Public private partnerships like the Bespoke Gene Therapy Consortium is one example of a collaborative environment specifically focused on rare diseases [$75M total project funding]. Decentralized Science (DeSci) is an experimental framework for facilitating more open-access to publicly funded research and development [$45B in NIH funding for biomedical research in 2022]. In a DeSci model, the ownership of intellectual property is fluid and distributed over the many institutions that contribute to and use it.

An Innovative Experiment

The Decentralized Science model could become the collaborative platform that facilitates a much needed inflection point into Eroom’s Law. In the case of genetic medicine for rare diseases, the current state of the industry already maps well with an envisaged implementation. There are already 100s of autonomous advocacy and research institutions developing novel therapies for different rare diseases. While the genetic ‘fix’ behind each of these products is different and competitive, other building blocks like vector design, manufacturing process, analytical methods, formulation, supply chain, trial design etc. could be non-competitively applied across independent programs. And then there is the untapped value in the data generated on the platform…

The adoption of Decentralized Science as a collaborative approach to drug development is still in its infancy. The concepts for Decentralized Science and the supportive infrastructure still lack the off-the-shelf ease of use required for mass adoption. The conservativeness of the pharmaceutical industry will also need more exposure to understand and open up to new ways of working. The well-published economic challenges in rare diseases offer a reduced barrier to entry, as many players are actively looking for alternative business models to develop these bespoke therapies. On the tech side, DeSci communities are looking for legitimate case studies to gain traction in mainstream science. Bringing these two communities together will be mutually transformative.

One last side note, the big brother of Decentralized Science is Decentralized Finance (DeFi). The total “perceived” value of assets traded on blockchain stands at $1.3T, almost 25% of the market cap of the pharmaceutical sector. Roughly equivalent to the sum of the bottom 686 global publicly traded companies [everybody smaller than Bayer]. Reallocating even a fraction of this decentralized capital to fuel the development of moon-shot therapies for rare diseases could provide comparable returns, through equally risky assets, while simultaneously contributing to societal benefits.

When developing gene therapies for rare genetic diseases, one might have thought genetically engineering human embryonic cells to make a virus that carries the cures for countless diseases would be the hard part; maybe not.